E U R O P E A N B A N K I N G A U T H O R I T Y

8

In order to facilitate the consistent participa-

tion of third-country supervisory authorities

in supervisory colleges, and improve cross-

border cooperation, the EBA assessed the

equivalence of the confidentiality

regimes of

a number of non-EU supervisory authorities.

The assessment resulted in a positive evalu-

ation for six non-EU supervisory authorities

from four countries, allowing the participa-

tion of these authorities in EEA supervisory

colleges.

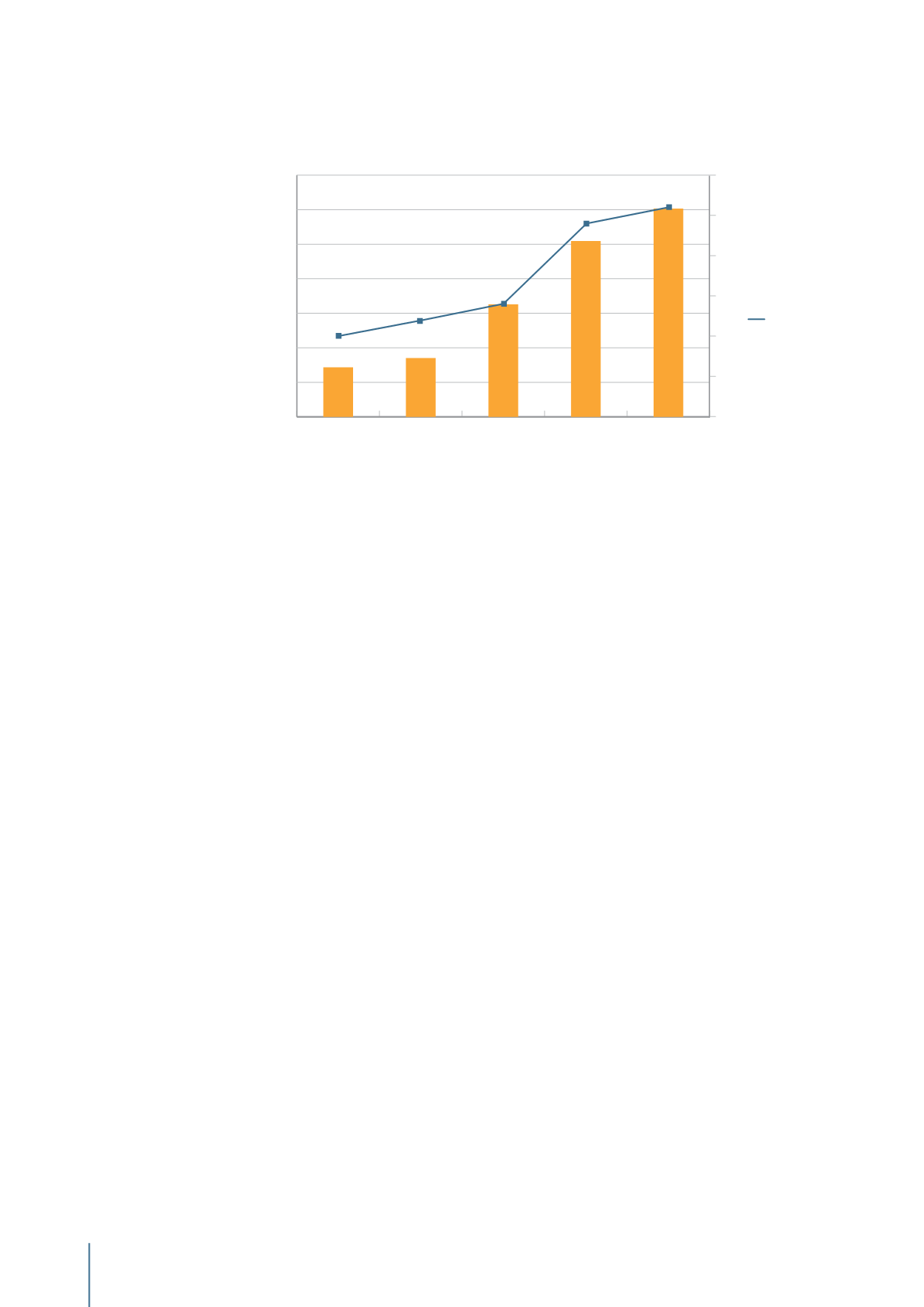

The EBA’s

training programmes

for EU com-

petent authorities are a key instrument to pro-

mote supervisory convergence. In 2016, the

EBA organised 26 training courses, of which

18 were sectoral, four online, two cross-sec-

toral and two on soft skills.

Monitoring key risks in the

banking sector across Europe

The EBA plays an important role in monitor-

ing and assessing o market developments, as

well as identifying trends, potential risks and

vulnerabilities across the EU banking system.

In 2016, the EBA continued to produce a regu-

lar

Risk Assessment Report (RAR)

. The RAR

describes the main developments and trends

that have affected the EU banking sector dur-

ing the year and provides the EBA’s outlook on

the main microprudential risks and vulner-

abilities for the future. In 2016, the RAR was,

for the first time, complemented with the EU-

wide transparency exercise.

The EBA conducted an

EU-wide transparency

exercise

during the second half of 2016. This

exercise is part of its work to promote market

discipline and foster consistency in banks’ dis-

closures, which the EBA has been carrying out

since 2011, either linked to concurrent stress

tests or as stand-alone exercises. The exer-

cise comprised 131 banks, from 24 EU Mem-

ber States and Norway, and was published on

2 December 2016 in parallel with the RAR. The

EBA published on its website an extensive col-

lection of bank-by-bank data that was in line

with past exercises.

The

Risk Dashboard

is another important

product in the EBA’s regular risk assessment

toolkit. It summarises the main risks and vul-

nerabilities in the banking sector by means of

the development of a set of risk indicators. It

was published on a quarterly basis in 2016.

The

Risk Assessment Questionnaire (RAQ)

is a semi-annual exercise, conducted among

banks and market analysts, providing a deep-

er understanding of the market participants’

views and outlook on challenges ahead. With

the first-time publication of a booklet cover-

ing the whole set of the results in June and

December, the EBA expanded its set of risk

assessments provided to the general public.

Figure 2:

Increase in number of training programmes and participants from 2012 to 2016

trainings

paricipants

2012

2013

2014

2015

2016

0

200

400

600

800

1000

1200

1400

30

25

20

15

10

5

0

Number of participants

Number of trainings