E U R O P E A N B A N K I N G A U T H O R I T Y

14

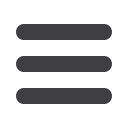

Figure 4:

Breach of Union law cases handled in 2016

Inadmissible

20%

National authorities give full

efect to Union Law after

preliminary enquiries

13%

Not open investigation because other

more suitable body or means for

dealing with the request

20%

Pending at the end 2016

47%

Conducting peer reviews

In 2016, the Review Panel conducted a peer

review of the ITS on Supervisory Reporting.

This peer review started in October 2015 and

the final report was approved by the BoS in De-

cember 2016. The exercise consisted of a self-

assessment carried out by CAs, followed up by

the review conducted by peers. It was the first

time that the EBA’s Review Panel performed

on-site visits to all EU CAs, plus the ECB/SSM

and three EFTA countries. Overall, the exer-

cise concluded that there were no significantly

negative outliers and all CAs had set up fully

or largely comprehensive processes to monitor

institutions’ reporting and assess data quality.

Impact assessment

of regulatory proposals

In 2016, the EBA published two reports on

monitoring the impact of the transposition of

the Basel III requirements in the EU – in March

for data as at June 2015, and in September for

data as at December 2015 – under a static bal-

ance sheet assumption. In addition, the EBA

conducted several ad-hoc monitoring exer-

cises to assess the impact of the new Basel

reforms on EU banks. In 2016, these ad-hoc

exercises included Quantitative Impact Stud-

ies (QISs) on BCBS proposals relating to credit

risk (Internal Ratings-based Approach and

Standardised Approach), FRTB, operational

risk, LR and output floors on the total RWA.

At the end of 2016, the EBA published a Re-

port on the cyclicality of banks’ capital re-

quirements under the applicable regulatory

framework in the EU (CRD IV/CRR), assess-

ing whether that framework tends to amplify

feedback loops between bank capital and the

real economy in a procyclical manner. The

EBA also published two reports on the imple-

mentation of the MREL, a report on liquidity

measures under Article 509(1) and the review

of the phase-in of the liquidity coverage re-

quirement under Article 461 of the CRR.

Maintaining the

Interactive Single Rulebook

Much work has again gone into answering

questions from stakeholders regarding the in-

terpretation and implementation of the Single

Rulebook. By 31 December 2016, around 3 075

questions (compared with 2 550 at the end of

2015) were submitted via the web interface.

Of these about 1 120 were rejected or deleted

(up from about 930 at the end of 2015), about

1 110 answered (up from about 830 at the end

of 2015) and about 845 are currently under re-

view (up from about 790 at the end of 2015). Of

the questions under review, about 95 are on

the BRRD and about five are on the DGSD. The

remaining c. 745 are on the CRR-CRD, with

the majority (about three quarters) focusing

on reporting issues, followed by questions on

credit risk, liquidity risk, own funds and mar-

ket risk-related issues.